BTC Price Prediction: Analyzing the Path to $115,000 and Beyond

#BTC

- BTC trading above 20-day MA indicates underlying bullish momentum

- Institutional accumulation and regulatory progress support higher price targets

- Bollinger Band upper resistance at $115,934 represents key near-term objective

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

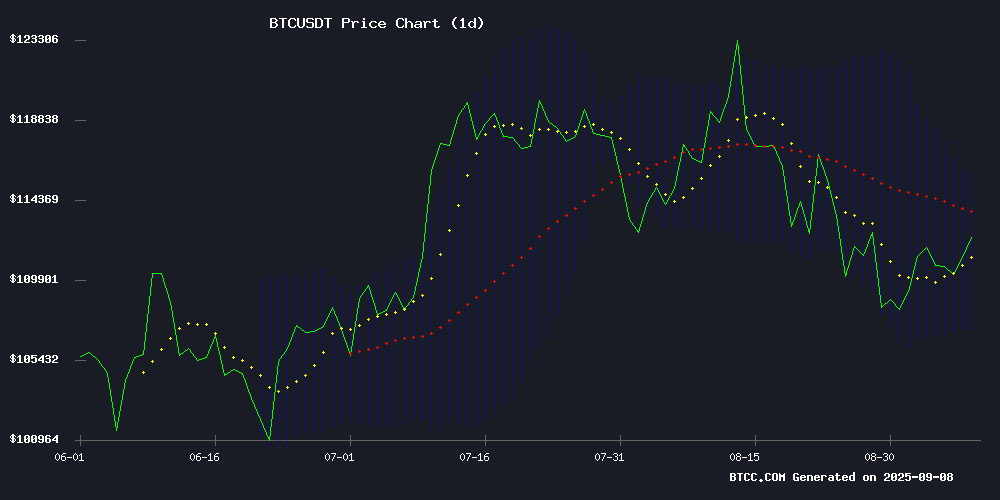

BTC is currently trading at $111,920.91, positioned above its 20-day moving average of $111,530.16, indicating underlying strength. The MACD reading of -726.38 suggests some near-term bearish momentum, though the price holding above the moving average provides support. John from BTCC notes that 'the current positioning above the middle Bollinger Band at $111,530 shows buyers remain in control, with potential resistance NEAR the upper band at $115,934.'

Market Sentiment: Institutional Interest Grows Amid Regulatory Progress

Positive market developments including US Senate advancing pro-crypto regulation and Standard Chartered revising Fed rate cut forecasts are creating favorable conditions. John from BTCC observes that 'while September has historically been challenging for Bitcoin, current institutional accumulation patterns and regulatory clarity are overriding seasonal trends. The market's ability to hold near $110,500 despite potential headwinds demonstrates resilience.'

Factors Influencing BTC's Price

Bitcoin's Rally Sparks Altcoin Momentum as Market Eyes $115k

Bitcoin has consolidated above $110,000 for weeks, forming a new support level that analysts interpret as the foundation for its next upward leg. The asset's recent acceleration toward $115,000 has reignited market-wide bullish sentiment, with institutional adoption patterns now validating its store-of-value thesis.

Altcoins are riding Bitcoin's coattails, attracting fresh capital inflows as confidence returns to crypto markets. Sovereign entities and corporate treasuries continue accumulating BTC, deepening liquidity pools and reinforcing its divergence from inflationary fiat currencies.

Technical indicators suggest the $100,000 threshold has become a durable floor after 120 days of sustained trading above this level. Market structure resembles previous accumulation phases before major breakout events, though some traders remain cautious about overextended positioning.

Upbit Parent Company Dunamu Rumored to Launch Blockchain Network 'GIWA'

Dunamu, the parent company of South Korea's largest cryptocurrency exchange Upbit, appears poised to enter the blockchain infrastructure space. Trademark filings for "GIWA"—Korean for "Tile"—suggest a foundational network designed to support decentralized applications and digital asset issuance.

The move signals a strategic expansion beyond trading services, potentially positioning Dunamu against global competitors with proprietary chains. Industry speculation centers on an official announcement during the upcoming Upbit D Conference in Seoul, where such infrastructure projects typically debut.

CryptoAppsy Delivers Real-Time Market Intelligence for Crypto Traders

CryptoAppsy emerges as a critical tool for cryptocurrency investors navigating the volatile digital asset markets. The mobile application provides instantaneous price tracking across thousands of tokens, including major players like Bitcoin ($112,255 referenced) and emerging altcoins, without requiring user registration.

The platform's low-latency data aggregation from global exchanges enables traders to identify arbitrage opportunities and market movements as they happen. Portfolio management features allow manual input of holdings with automatic valuation updates, while customizable price alerts and historical charting complete the analytical toolkit.

Bitcoin Faces 'Red September' as Institutional Interest Grows

Bitcoin enters September 2025 under the shadow of its historical weakness during this month, dubbed 'Red September.' Regulatory pressures and tightening cycles have traditionally dampened sentiment, but this year tells a different story. Spot Bitcoin ETFs are sustaining multi-billion dollar volumes, funneling institutional capital into the market.

Corporate treasuries and struggling firms are increasingly adopting Bitcoin as part of their reserve strategies. OurCryptoMiner's CEO Yvette Jayne asserts, 'Our full holding strategy reflects conviction in Bitcoin's role as a future treasury reserve asset.' The cryptocurrency's rebound to $112,000 has sparked debate—while some see volatility, miners view it as a strategic accumulation window.

Tether CEO Denies Bitcoin Sell-Off Amid Misinterpreted Reports

Tether CEO Paolo Ardoino has refuted claims that the stablecoin issuer liquidated any of its Bitcoin holdings. Rumors emerged following a misreading of the company's Q1 and Q2 2025 attestation reports, which seemingly indicated a decline in Bitcoin reserves. Ardoino took to X to clarify, asserting that Tether "didn’t sell any Bitcoin."

The confusion stemmed from a YouTuber's observation of reduced Bitcoin holdings in Tether's reports. Jan3 CEO Samson Mow later explained the discrepancy, attributing it to a transfer of 19,800 BTC to an investment vehicle called Twenty One Capital (XXI). On-chain data corroborates the movement, showing two major transactions to XXI in June and July.

Market participants had speculated that Tether was swapping Bitcoin for gold, a theory now debunked. The incident underscores the importance of accurate data interpretation in the volatile crypto space.

Robinhood Soars on S&P 500 Inclusion as Bitcoin-Linked Strategy Gets Snubbed

Robinhood (HOOD) shares surged 15% Monday after securing a coveted spot in the S&P 500 index, capping a year where the trading platform's stock nearly tripled. The inclusion, effective September 22, validates the company's position among U.S. equity leaders after being one of the largest eligible firms awaiting admission.

Meanwhile, Bitcoin development firm Strategy (MSTR) saw shares dip 1.5% despite meeting S&P's financial thresholds with $14 billion operating income. The committee likely balked at its Bitcoin-dependent earnings structure. "We didn't expect first-quarter eligibility to guarantee inclusion," conceded CEO Michael Saylor on CNBC, acknowledging BTC's volatility as a factor.

Strategy Expands Bitcoin Holdings with $217 Million Purchase Amid Market Highs

Strategy has acquired an additional 1,955 BTC for approximately $217.4 million, paying an average of $111,196 per bitcoin. This latest purchase underscores the firm's aggressive accumulation strategy, even at historically elevated price levels. The company now holds 638,460 BTC, acquired at an average cost of $73,880 per coin, representing tens of billions in unrealized gains.

Year-to-date, Strategy's Bitcoin holdings have yielded 25.8%, benefiting from BTC's 2025 rally above $110,000. The announcement was made via social media, accompanied by the firm's trading tickers—$MSTR, $STRC, $STRK, $STRF, and $STRD—a signature move for its Bitcoin-focused disclosures.

While most institutions shy away from such high-price acquisitions, Strategy continues to double down on its leveraged Bitcoin bet. The firm's unwavering conviction contrasts sharply with conventional corporate treasury strategies, positioning it as a bellwether for institutional crypto adoption.

Standard Chartered Raises Fed Rate Cut Forecast, Crypto Market Reacts

The crypto market is surging on renewed optimism as expectations grow for aggressive Federal Reserve rate cuts. Standard Chartered now predicts a 50-basis-point reduction in September—double its previous forecast—following dismal August jobs data showing just 22,000 new positions versus 75,000 expected.

Bank of America echoes the dovish sentiment, projecting consecutive quarter-point cuts in September and December. This monetary pivot is fueling bullish momentum across digital assets, with Bitcoin leading the charge as traders anticipate liquidity injections.

Labor market weakness has become the catalyst for repricing Fed expectations. The abrupt slowdown in job growth suggests economic cooling that could accelerate cryptocurrency adoption as both hedge and high-beta play.

US Senate Advances Pro-Crypto Regulation as DeepSnitch Presale Gains Momentum

Bitcoin stabilizes amid regulatory developments as the US Senate moves closer to establishing a favorable framework for digital assets. A new clause in the Responsible Financial Innovation Act aims to prevent tokenized stocks from being misclassified as commodities, signaling growing institutional acceptance under the Trump administration's pro-crypto stance.

Investor attention shifts to emerging ICOs like DeepSnitch AI, whose presale has neared $200,000. The project's artificial intelligence capabilities for market analysis are drawing significant demand, positioning it as a potential standout presale for 2025. This comes alongside recent legislative milestones including the CLARITY Act, creating a more structured environment for crypto innovation.

Former Trader Alleges Quantum Tech Used to Steal Bitcoin from Dormant Wallets

Former Wall Street trader Josh Mandell has sparked controversy with claims that quantum technology is being covertly employed to siphon Bitcoin from inactive wallets. Mandell, who gained recognition earlier this year for a precise Bitcoin price forecast, asserts that a significant entity is accumulating Bitcoin without leaving a trace on the open market.

The Bitcoin community has swiftly dismissed Mandell's theory as implausible. Industry figures like Harry Beckwith and Matthew Pines have publicly refuted the notion, emphasizing the current infeasibility of quantum attacks on Bitcoin's cryptographic security. While quantum computing remains a theoretical future threat, experts maintain that on-chain analytics would detect such breaches long before they could occur at scale.

Blockchain analysts note that while quantum decryption could eventually compromise poorly secured legacy wallets, the network's proof-of-work mechanism and widespread use of quantum-resistant addresses provide robust protection. The debate highlights growing concerns about securing early Bitcoin holdings as the technology landscape evolves.

Bitcoin Holds Firm Near $110,500 as Traders Eye Next Move

Bitcoin continues to consolidate just below the $110,500 level, a critical psychological threshold that has captured market attention. The cryptocurrency's resilience at this price point suggests a brewing battle between bulls and bears, with on-chain data and technical analysts highlighting it as a decisive zone.

Market observers note that maintaining above $110,500 could pave the way for a push toward $115,000-$116,000, while a breakdown below $107,800 may trigger nervous selling. Stablecoin inflows and cautious optimism appear to be supporting the current price action.

Two distinct scenarios emerge: A decisive breakout above $113,000 with strong volume could propel BTC toward $120,000, particularly if bulls maintain control. Conversely, some analysts warn of a potential 15-25% correction if support levels fail to hold.

How High Will BTC Price Go?

Based on current technical and fundamental analysis, BTC shows potential to test the $115,934 resistance level in the near term. The combination of strong institutional accumulation, with Strategy adding $217 million in Bitcoin holdings, and positive regulatory developments creates a constructive environment. John from BTCC suggests that 'breaking above the Bollinger upper band could open a path toward $120,000, though traders should monitor the MACD for any divergence signals.'

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $111,920.91 | Bullish above MA |

| 20-Day MA | $111,530.16 | Support level |

| Bollinger Upper | $115,934.26 | Near-term target |

| MACD | -726.38 | Watch for reversal |